Investing is a concept everyone should know about but few actually take the time to understand. In this Guide to Investing we’ll talk about basic investing concepts like Stocks and Bonds, Risk, and Portfolio Management, but we’ll also delve into advanced concepts such as Cryptocurrencies, Options, Commodities, and more. The goal of this article is to give you a basic understanding of the topic of investing and provide you with quality references to learn more — to that end you’ll find links to videos, books, and other quality websites that can help you expand your education on this important topic.

Table of Contents

(This list is long. Skip ahead to the sections that interest you).

- Disclaimer

- Know the Risks

- Develop YOUR Personal Trading Philosophy

- Investing in Bonds (Intermediate)

- Investing in Commodities (Intermediate)

- Cryptocurrencies (Intermediate)

- ETFs & Mutual Funds (Beginners & Intermediate)

- Investing in Gold and Silver (Beginner & Intermediate)

- Investing in Options (Intermediate)

- Getting Started in Stocks (Beginners)

- Day Trading vs Swing Trading

- Dividend Investing

- Fundamental Analysis

- Roboinvesting Services

- Technical Analysis

- Value Investing

Editor’s Note from That Helpful Dad: This article is written by Michael Thomsett – one of the most-published authors in the world on the subject of investing and options trader.

Michael Thomsett has been actively involved in the investment world for over 40 years and has published countless books on finance and investing. At ThatHelpfulDad.com we’re thrilled to be able to showcase some of Michael’s work for you and hope you enjoy learning from him.

Perhaps most importantly, Michael Thomsett has been a friend and mentor to That Helpful Dad for over a decade. My life has been improved from Michael’s wisdom and I hope yours will be too.

DISCLAIMER – all the information you see here is for educational purposes only. Neither Michael Thomsett nor anyone at ThatHelpfulDad.com is recommending you make any investments based on what you read here. Please consult with a licensed financial advisor before you make any investment decisions.

For tips on finding a financial adviser, read this article from The Balance.

Know the Risks

Where people invest and how they choose products, determine to a large degree whether the investment program they use will succeed or fail. With so many investment plans to follow, you may select a low-risk or a high-risk portfolio, or attempt to balance the two.

Risk is the core concern that most people need to pay attention to, and unfortunately, this is one aspect of investing most often ignored. The tendency for many is to focus on the potential rewards of a particular course of action, but to overlook the serious risks that are unavoidable. That’s a problem – and that’s where we can help.

This article includes discussion and brief introduction of many investment topics – with an eye on risk.

The first step in accomplishing your investing trading goals is to know the risks and the attributes of each type of investment.

This guide to investing introduces many of the most popular types of investments and their risk; but this guide is only a starting point. By researching further using the links we recommend, you will gain an understanding of both rewards and risks, and start the journey toward control of your investment dollars.

Being aware of risk applies equally to new AND experienced investors.

- Are there blind spots in your assumptions?

- Have you beaten the odds so far and overlooked risks to which you are exposed?

Everyone can review their portfolio, range of products and underlying assumptions to improve their positions and maintain control over exposure to risk – and the knowledge you gain here will help you.

To learn more about how Risk affects your investments, here are some links to check out.

- What is Risk? Investor.gov

- Investment Risk Explained – FINRA.org

Develop Your Personal “Trading Philosophy”

The typical “crowd mentality” of the market is reactive and emotional.

The tendency is for many people to buy into the market as it reaches a top and to sell as the market reaches a bottom.

The prevailing emotions of the market are GREED and FEAR. Consequently, rather than following the advice to “buy low and sell high,” the majority of traders tend to “buy high and sell low.”

A better approach to investing that has proven itself over time is “buy and hold.”

This is the approach used by Warren Buffett, Jack Bogle, and other legendary investing gurus.

How does The Buy & Hold Strategy work?

A strong company is identified, and its stock is purchased and held indefinitely. Many decades ago, “buy and hold” was the most popular strategy. The average holding period for stocks was 8 years. With the introduction of the Internet, trading became easier and cheaper, and the buy and hold concept fell out of favor. Today, the average holding period of stocks is a matter of a few months rather than of years.

Another way to think about when (or if) to buy and sell stock is based on whether you give in to the crowd mentality dominated by emotion, or use cold logic and reason. A contrarian investor is not merely a person who contradicts what most people do; the contrarian makes decisions based on analysis and reason, and ignores the emotional tendency to make decisions at the wrong time (buy high, sell low).

Bottom line: don’t fall the crowd!

Get some basic education. Here are some of the best all-time books for basic understanding of investing – these will help you develop a trading philosophy build on WISDOM.

I-How to Invest in Bonds (For Intermediate Investors)

What is a Bond?

A bond is called a debt instrument. When you buy a bond, you are lending money to the issuer (government or corporation). The issuer promises to repay the bond plus interest on a predetermined schedule, including interest. Bonds can be bought directly or through an income mutual fund.

Who sells Bonds?

Issuers include the U.S. government, state governments and agencies, and local agencies raising money for infrastructure projects. At first glance, a bond might seem like a fairly straightforward idea. The issuer promises to repay and gives bondholders first priority, meaning they will be repaid before stockholders and others in the event the company goes out of business. Bonds are all rated by one of the major rating services, including Standard & Poor’s, Moody’s, and Fitch.

How are Bonds rated?

A highly-rated issuer offers investment grade bonds and ratings are AAA or Aaa. Investment grade has several tiers of ratings. Below investment grade are speculative bond issuers, rated Ba1 or BB+. The highest-risk investments, bonds most likely to go into default, are rated C or D. Many bond investors overlook the risks in picking bonds, even junk bonds (likely to default) because the interest rate is higher than average. But this is a mistake.

How much to Bonds cost?

Bonds may be available at any time at face value ($1,000 for a $1,000 bond) or at a premium or discount. When the interest rate offered on a bond is lower than current market rates, the bond will be available at a discount. For example, if a bond is at 98, it has been discounted two points. A $1,000 bond can be bought or sold for $980. When the interest rate is higher than current market rates, a bond is sold at a premium because the higher rate makes it desirable. A bond listed as available for 103 has a 3% bump, so a $1,000 bond can be bought or sold for $1,030.

How do you buy Bonds?

Bonds may be purchased directly or as part of a mutual fund or ETF. For those investors requiring their money be managed professionally, a bond mutual fund is the most sensible way to go, versus figuring out how to buy a bond directly.

Links to learn more about Bond Investing:

1. Investing in Bonds for Beginners – Motley Fool

2. Tips BEFORE you invest in Bonds – FINRA.org

3. How to Buy Bonds – NerdWallet.com

Video Education about Bonds

Books about Investing in Bonds

II-Investing in Commodities (For Intermediate Investors)

What is a Commodity?

Commodities (also called futures contracts) are agreements between potential buyers and sellers to fix the price of a future trade. The most widely traded commodities are in the energy market. Futures also are traded on agricultural products, currency rates, interest rates, metals and many more.

How does a commodity investment work?

A commodity buyer agrees to a specified price for a known quantity of a commodity, and seller agrees to provide that price for the goods involved. The origin of commodities is in the agricultural markets. Farmers used to take significant risks deciding what to grow, because the future market prices might not be high enough to produce a profit. As a result, commodities fixed the future price so that growers would proceed with some certainty that their crops would sell at a high enough price to justify selecting one crop over another.

Today, the commodities contract has become much more than just a future price guarantee. As a leveraged contract, the market includes many speculators on both the buy side and sell side. Anticipating the direction of price movement, a buyer would expect a contract to increase in value and a seller would expect it to decline. So whether trading in corn, soybeans, frozen orange juice, gold, treasury securities, or oil and gas, the commodities trader often is not a true trader in the underlying commodity but in the contract itself.

Just as options have standardized terms, so do futures. Terms include the underlying commodity, the amount covered by each contract, the grade or quality if applicable, and location for delivery upon exercise. Trading of futures contracts occurs at a commodity exchange. High-volume exchanges include the Chicago Board of Trade (CBOT), parent company of the Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYMEX) and Commodities Exchange (COMEX).

Commodities trading is expensive and demands a high level of skill and knowledge. For this reason alone, most individuals will not want to directly deal in buying and selling contracts, but will prefer to trade through a commodities-based mutual fund or exchange-traded fund. The top ETFs specializing in commodities is one place to begin searching for as way to trade in this specialized field. More traditional mutual fund investors can also select funds specializing in commodities. Investors can also buy shares of companies that produce and market commodities (energy, agriculture, mining, etc.).

Links to learn more about Investing in Commodities

1. What is Commodity Investing? – Fidelity.com

2. Commodities Trading Overview – Investopedia.com

Video Education about Commodities Investing

Books about Commodities Investing

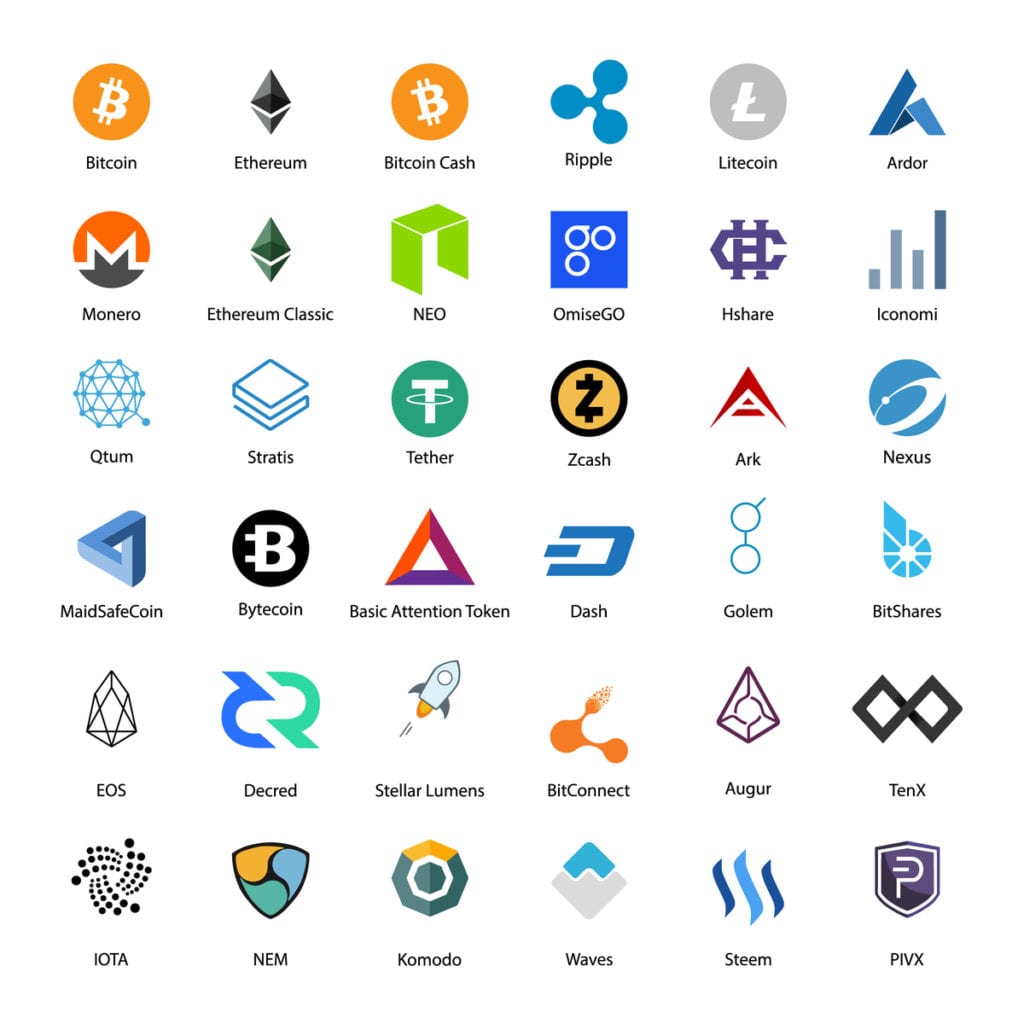

III-Cryptocurrencies – The Future of Investing? (Intermediate Investors)

Bitcoin, Litecoin, Ripple, Ethereum, and more.

Perhaps the most misunderstood investment is also the newest. Cryptocurrency demands a complete explanation and summary in order to understand exactly what it is and how it works.

Who invented Cryptocurrency?

Crypto’s were introduced in 2008 with Bitcoin, invented by Satoshi Nakamoto. He described this as a “peer-to-peer electronic cash system.” This involved creating a decentralized digital system. Previous efforts at setting up a digital currency had all failed. Any monetary system is based on accounts, balances and transactions. In traditional banks, assets are insured and kept safe physically.

The challenge to a digital money system is keeping non-physical value safe from theft or hacking. Without the server or bank to provide this, every participant has to ensure safety and protection for themselves.

Cryptocurrency solves this problem.

It requires a database in which not just anyone can change value or enter transactions. This actually is the same requirement for a physical bank account, but it is done digitally.

How does it work?

Those acting in the crypto network sets up a record of all transactions. The peer-to-peer (p2p) technology is based on a public key cryptography, an announcement of transfer in value. For example, one person transfers Bitcoin to another and a public key announces the transfer. It’s that simple. But if you are the owner of cryptocurrency, how is your ownership protected? This is accomplished through coding and encryption.

Cryptocurrency is nothing more than a digital currency, competing with the physical currency everyone recognizes. However, because these currencies are transacted all around the world and traded with high volume, the actual value changes daily. Many have speculated and have seen values rise and fall rapidly.

Crypto is not only a currency, but a system.

It changes in value so it is also speculative in many respects.

But as more companies begin accepting crypto as payment for services, it will gain in public acceptance. Growing pains for this new industry were obvious, for example when in January, 2018, the North American Bitcoin Convention would not accept Bitcoin for payment of registration fees.

Links to learn more about Cryptocurrency Investing

1. How to invest in Crypotocurrency – Yahoo Finance

2. How to buy Bitcoin – Investopedia.com

3. What is Cryptocurrency – Nerdwallet.com

Video Education about Cryptocurrencies

Books about Cryptocurrency Investing

IV-How to Invest in ETFs and Mutual Funds

What is a Mutual Fund?

Mutual funds are organizations that invest for thousands of individuals. Funds are combined to create portfolios and are managed professionally. Selection of investments is based on the stated purpose of each fund (income, growth, aggressive growth, safety, etc.).

The size of a mutual funds varies. As of 2018, the biggest mutual fund is operated by Vanguard, and reports assets under management of $657 billion. This company manages several mutual funds and other types of accounts. But is bigger always better? With such a large presence in the market, a large fund cannot move quickly. If they want to dispose of shares in one company, doing so all at once would negatively impact share prices; as a result, a large fund is forced to buy and sell in smaller increments than they might want to otherwise.

What is an Open-Ended Mutual Fund vs a Closed-End Mutual Fund?

This is an example of how an open-ended fund works. That means there is no limit on how much is placed in the fund. A closed-end fund, in comparison, sets a limit. You can buy shares in a closed-end fund over a public exchange, and the value of shares is a reflection not only of how well the fund has performed, but on how many people want share.s The supply and demand affects the asset value.

How do Mutual Funds Perform vs the Stock Market?

Performance is measured by net return. Mutual funds, on average, yield less than the average of the overall market. Timing of decisions is one cause of this; another is a requirement that a portfolio on assets must be kept in cash, so that when shareholders want to cash out, funds are available for prompt payment.

How do Mutual Fund Fees work?

Funds are further analyzed by what they cost. A complex array of fees may be charged. The most common is a load fee, which translates to a commission for salespeople who direct their clients to a fund. The load may be as high as 8.5%, meaning that out of every $100 invested, $91.50 goes into the mutual fund and $8.50 goes to the salesperson. The argument is that you pay an expert to direct you to the best funds, but in fact, funds you can buy directly — no-load funds — may perform as well and sometimes better than a comparable load fund.

Beyond the load are many other fees and costs. All funds charge a management fee to pay the professionals who make portfolio investment decisions. Many funds charge a fee to promote the fund to more investors, and calculate many other fees as well. Making valid comparisons is a challenge. The Financial Industry Regulatory Authority can help. FINRA) offers a free calculator to make comparisons accurately. This is a great tool for anyone considering investing in a mutual fund.

What is an ETF vs a Mutual Fund?

One alternative to the traditional mutual fund is the exchange-traded fund (ETF). This is a mutual fund that comes with a predetermined basket of securities with something in common. It is fixed and does not change. The typical basket may consist of stocks of companies in one industry, in a country, or by levels of market risk. Some ETFs are based not on stocks, but on debt securities like bonds of countries or regions, or on the currency exchange rates of a region.

What are the benefits of an ETF vs a Mutual Fund?

The ETF automatically diversifies a portfolio, which is a positive aspect of selecting an ETF. But it also tends to average out to the net returns (profits or losses) of all components in the basket. For many, the ETF is not as effective as a traditional mutual fund. However, whereas mutual fund shares can be bought or sold only directly with the mutual fund’s management, the ETF is traded on the public stock exchanges, so trading is easier and more immediate. ETF investors can also trade options on the fund rather than buying shares, or as a way to hedge market risk of ownership in the ETF.

Links to learn more about Mutual Funds vs ETFs

1. Comparing ETFs and Mutual Funds – Vanguard

2. ETFs vs Mutual Funds – Dave Ramsey

Video Education about Mutual Funds and ETFs

Books about Mutual Fund Investing

V-Investing in Gold and Silver

Why are gold and silver worth money?

So-called “precious metals” have a few attributes in common. As far as their value goes, it is their rarity that matters. Utility is a second key attribute. God, silver and many other precious metals are used in coinage, jewelry, medicine and dentistry, research and many types of construction. The third attribute is perception. Throughout history, discoveries of gold, for example, have caused gold rushes. Although few people got rich in these fevers, the perception was that anyone going to the area (whether Sutter’s Mill in California or the Klondike in Yukon Territory, Canada, hundreds of miners .lost their entire fortune and even died, while those who supplied shovels, pans, tents and other equipment often were the primary beneficiaries of the influx of people.

Gold is rare.

All of the known gold in the world would only fill 3 1/4 Olympic-sized swimming pools.

While this might seems like a small worldwide supply, platinum is ever rarer.

All of the known platinum in the world would fit into one of those pools and cover only two to three inches.

Silver is less rare but widely used in many fields, notably coinage and jewelry. Its per-ounce value is much lower than gold’s but it remains a popular item for speculation, in the form of coins and silver bars.

How do you invest in precious metals?

You can buy the actual physical metal in the form of bullion. Or as an alternative to investing directly in physical gold and silver, or buying shares of mining companies, many people today prefer to buy shares of ETFs that track the value of previous metals. The most popular of these are SPDR Gold Trust (GLD) and iShares Silver Trust (SLV). Shares of both can be purchased on the stock exchanges during trading hours, and both offer options in addition to purchase of shares.

Links to learn more about Buying Gold and Silver

1. How to invest in Gold – Motley Fool

2. Four Ways to Buy Gold – Forbes.com

3. Investing in Silver – SmartAsset.com

Video Education about Gold and Silver Investing

Books about Investing in Gold and Silver

VI-Investing with Options (Intermediate and above)

What are Options?

One of the most complex of investment vehicles is the option, an intangible contract that provides its owner the right to buy or sell 100 shares of a stock or other security. Terminology is a particular challenge for anyone new to options, and levels of risk must be fully understood before anyone trades in options. Options trading can be high-risk or extremely conservative, depending on which of the dozens of strategies is selected. But it doesn’t have to be this risky – if you equip yourself with a big of knowledge, options trading can actually help you reduce stock market risk dramatically.

Here is a basic summary of how options investing works:

There are two types of options. Calls give their owner the right (but not the obligation) to buy 100 shares of a particular stock, at a fixed price and by or before a known date. Puts give their owner the right (but not the obligation) to sell 100 shares of stock.

The fixed price specified by the option is called the strike. This is the price per share an option holder can get when buying (with a call) or selling (with a put) 100 shares of stock.

The stock or other security is called the underlying and this is the security for which 100 shares per option can be traded.

Every options has a limited life. Its expiration is known in advance, and with monthly options it is the third Saturday of expiration month, which may be one month away or as far away as 30 months.

These are the four “standardized terms” of every option. The type of option (call or put), strike, underlying and expiration and fixed and cannot be changed. Collectively, they determine the value of an option, called its premium and this changes as the value of the stock rises or falls and as expiration date approaches.

What is an option ‘premium?’

The value of premium is divided into three parts. Intrinsic value represents the number of points that an underlying is above the strike of a call or below the strike of a put. Time value varies based on the time to expiration, and it declines as expiration approaches, ended up at zero by the point of expiration. Extrinsic value (also called implied volatility) is the ever-changing value of the option based on the trading range of the underlying stock. This has to be estimated because it attempts to guess the future value of an option based on the price behavior of the underlying, and this form of value is where all of the uncertainty and unknown factors are located.

Options trading techniques

The potential of options as a trading device is rich and flexible. Options can be bought or sold as speculative moves or as highly conservative ways to hedge market risk.

The most obvious form of trade is the long option, the purchase of calls or puts. A trader buys a call in the belief that the underlying price will rise above the strike, and will buy a put if the belief is that stock prices will fall.

Beyond buying long options, traders cal also sell short options. In this trade, the option is sold as an opening transaction and bought as a closing transaction. Instead of the familiar buy-hold-sell series of transactions, short options are traded in reverse, or sell-hold-buy.

Long and short options can be combined as well. In trading multiples of options, the spread is a trade in which two options are bought or sold at the same time,. A vertical spread has the same expiration but different strikes. A horizontal spread (also called a calendar spread) has the same strike but different expirations. A diagonal spread has different strikes and expirations.

The straddle is the purchase or sale of a call and a put with the same strike and expiration date. This can be varied with a strangle or one of several synthetic strategies.

The full range of possible variations in trades is complex, and rules apply for levels of collateral traders must maintain when selling options.

Basic options education

The process of learning about options is complex and demanding. Basic education can be gained from basic options books and online resources. The Options Industry Council (OIC) is the industry’s training and education website. It provides basic and advanced online courses helping traders to learn all about options. The Options Clearing Corporation (OCC) supports the OIC and is the clearing organization for options trades. Another resource for education is the exchange set up specifically to trade options. This is the Chicago Board Options Exchange (CBOE).

Beyond these industry associations, many other sites offer exceptional educational links, many of which are free.

Links to learn more about Options Investing

1. An Introduction to Options – Motley Fool

2. Essential Options Trading Guide – Investopedia.com

Video Education about Options Investing

Books about Options Investing

VII – Getting Started in Stock Investing

What is a stock?

The stocks of a corporation represent part ownership. With a company’s total worth in the millions or billions, large ownership would be possible for only a small number of exceptionally wealthy people or companies. However, anyone can buy stock in a company in the hope that its value will increase over time.

Stocks are listed on public exchanges like the New York Stock Exchange (NYSE) and NASDAQ.

Remember the movie Trading Places?

Stock Trading Techniques

Most people who buy stocks enter long positions. This means they buy.

The sequence of a typical trade is buy-hold-sell.

If the timing is right and the price per share rises, shares can be sold at a profit. If the share price declines, stock can be sold at a loss or held in the hope that price will rebound in the future.

Some traders believe the price will fall, and they enter a short position. This is the opposite, selling shares in the hope of a lower future price, when the shares can be bought and the position closed. The net difference between a higher short position and a lower long position will be the net profit. The risk of going short is that the stock price could rise, meaning the short seller could lose. This is a complex and risky way to trade. The first step is to borrow shares from the broker and then sell them. The broker charges interest for as long as the shares remain open. The trader has to not only benefit from a declining price per share, but also pay for interest and trading fees.

As an alternative to shorting stock, traders can also buy puts. The maximum loss on a put is limited to the premium paid, versus unlimited losses on short stock. If the stock price falls, the value of the put increases. For every point the stock falls below the put’s strike, the put will gain one point of value. However, puts expire in the future, so buying puts is a fight against time in two respects. First, when expiration occurs, the put will be worthless. Second, as expiration comes closer, the time value of the put declines with increasing speed.

Stock buyers and sellers may rely on the fundamentals (financial strength and earnings power) of a company. Or they may rely on technical analysis, the study of price trends and volatility as well as changes in volume, moving averages and momentum.

How to Invest in Stocks

How do you select a company as an investment? There are thousands of companies with publicly traded stock, ranging in price from a few pennies to thousands of dollars per share.

This daunting task is made easier with the application of a few principles. Most first-time stock investors may begin by identifying value investments. These are companies whose stock is priced at a bargain level, but whose dividend yield is attractive. Other criteria may be applied as well, usually based on strong fundamental indicators. Knowing future growth of a company and its stock value is never easy, but clues may be found by identifying a short list of companies with strong indicators in a few areas: growth in revenue and earnings, dividend yield and growing dividend per share, and strong or improving cash flow (management of cash coming in to the company versus cash going out).

A company should be able to compete strongly within its sector. This does not mean they must be the strongest company, but they should be able to claim and keep a decent market share of a finite population. Companies failing to keep up with changing technology and market preferences will not be value investments as their frame becomes obsolete. For example, why have most book stores gone out of business? Why is Sears closing stores and heading for bankruptcy? Did did big companies like General Motors and Kodak lose their markets? They did not keep up with changing market conditions and consumer preferences.

Selecting a stock should be based not on current fads but on how strongly the company has built a base for competing in the market and controlling its costs. A well-managed company will be able to identify what consumers expect, and anticipate what this will look like in the future. As long as management is able to see ahead, growing stock prices follow.

This is the best way to pick stocks:

Identify well-managed companies that compete strongly within their sector, and control costs to generate profits and cash flow.

Video Education about Stock Investing

Books about Stock Market Investing

Books from Michael Thomsett about Stock Market Investing

Day Trading vs Swing Trading

One popular way to trades in shares of stock is through day trading and swing trading.

What is Day Trading?

Day trading is a system of entering and exiting positions within a single day. The day trader believes that holding shares between sessions is high-risk because prices can change while markets are closed. This form of trading also avoids the rule of margin and collateral imposed by federal law and brokerages. Because margin is always based on value at the end of the trading day, the day trader is not required to post margin at all. The end-of-day balance is zero, even if the day trader has been involved in a high dollar volume of short trades.

What is Swing Trading?

Swing trading is substantially different than day trading. It involves holding open positions for a limited time, normally between two and five days. A swing trader tends to make decisions based on logic and observation, versus the more common emotional tendency of many traders. When an unexpected event occurs (like an earnings surprise), the stock price tends to move in an exaggerated fashion. The swing trader looks for this and recognizes the opportunity to enter a position, knowing that the exaggerated price move tends to self-correct within one to three days in most cases. This practice — timing trades logically rather than emotionally — is called contrarian investing, and is the most successful form of swing trading. This also requires the ability to recognize reversal signals and confirmation.

Learn more about Day Trading:

1. Day Trading – Is it Right for You? – NerdWallet.com

2. Day Trading Strategies for Beginners – Investopedia.com

Learn more about Swing Trading

1. Swing Trading – Investors.com

2. What is Swing Trading? – Fidelity.com

Video about Day Trading

Books about Day Trading and Swing Trading

Dividend Investing

Many traders base their trades on dividends.

So what is a dividend?

As Investopedia notes, “A stock dividend is a dividend payment made in the form of additional shares rather than a cash payout. Companies may decide to distribute this type of dividend to shareholders of record if the company’s availability of liquid cash is in short supply.”

What is a Dividend Achiever?

The most basic form of this is to pick stocks with exceptionally high dividends, notably those whose dividends per share has been increased every year for 10 years or more (these are called dividend achievers). Such stocks tend to perform above average in the market in terms of growth in value over time. In selecting high-dividend stocks, traders may also rein vest dividends in additional partial share purchase, rather than taking a cash payment. This sets up a compound return on the dividend yield.

Beyond picking high-dividend stocks, some traders time share purchases to earn the quarterly dividend. Buying shares immediately before ex-dividend date and selling shares on or after ex-dividend date, sets up the earnings of a quarterly dividend even though shares are held for only a few days.

A dividend capture strategy is an expansion of this strategy.

A trader buys a call and exercises it right before ex-dividend date, buying 100 shares (hopefully for a price below current market price). Once the dividend is earned, shares are sold. The quarterly dividend is earned even though the holding period was very brief. This can be repeated with different companies every week, meaning that instead of earning the stated yield, dividend income is increased substantially.

Links to learn more about Dividend Investing

1. Dividend Investing for Beginners – MotleyFool.com

2. Ultimate Guide to Dividend Investing – The Balance

Video Education about Dividend Investing

Books about Dividend Investing

What is Fundamental Analysis?

All of fundamental analysis is concerned with interpretation of financial strength. This includes the trend in revenues and earnings; dividend payout and yield; price/earnings ratio; long-term debt and total capitalization; and many more indicators.

The proponents of technical analysis study charts and try to anticipate how prices will move next. Although this is a valid part of overall analysis, it is not a matter of one or the other. Both fundamental and technical signals can and should be evaluated together.

History has shown that although there may be a lag between financial reporting and price behavior, strong fundamentals tend to lead directly to strong technical signals and price behavior. The fundamental measurement is financial information should not be performed only at one moment in time. It is more meaningful when studied as part of a fundamental trend over several years. A fundamental analyst looks for consistency: growing revenue and earnings, steady net return (earnings divided by revenue), consistent price/earnings ratio, growing dividend payment, steady dividend yield, and flat or declining long-term debt to capitalization ratio (the portion of capitalization represented by debt rather than equity).

Learn more about Fundamental Analysis

1. Stock Analysis 101 – ThetStreet.com

2. What is Fundamental Analysis? – Investopedia.com

Books about Fundamental Analysis

Roboinvesting Services

What is Roboinvesting?

Any automated or automatic form of investing can be classified as roboinvesting. The minimum level of human involvement in making decisions is the most important attribute to this strategy.

A new field has emerged to address this trend. Robo-advisors are financial advisors who refer clients to investment choices or who provide financial advice along these lines. A roboinvestment is based on application of computerized math or algorithms rather than on either fundamental or technical analysis. Dozens of individuals and firms have begun advising clients to invest in this manner. Based on risk profile of a client, the advisor will highlight stocks, commodities, mutual funds, ETFs, real estate and other investment choices. The ETF market is a prominent choice within this market.

For investors who doubt the value of personal advice and analysis, roboinvesting may be a viable system. However, the debate between human intelligence in decision making, versus automated and math-based selection of investments, continues. There are two attributes of the decision worth considering. First is the value (or flaw) in human intelligence. Second is the reliability of automated systems to properly identify opportunities and to highlight them.

Popular Roboinvesting Services:

1. Wealthfront.com

2. Betterment.com

What is Technical Analysis?

In technical analysis, a trader studies price patterns and trends. The purpose is to identify opportunities to enter and then to exit a trade and generate a net profit.

Fundamental analysis focuses on financial information and competitive strength of a company; technical analysis is based on the study of stock prices.

Price indicators come in many forms.

Two major classifications are Western and Eastern indicators. Typical Western indicators include double tops and bottoms, head and shoulders, gaps, and movements above resistance or below support. Eastern indicators come in dozens of formations, and also are called candlesticks. The candlestick chart is the most widely used form today, consisting of a series of sessions revealing direction of price movement, range of prices during a session, and opening and closing prices.

Patterns may indicate reversal and continuation. A reversal pattern appears near the top of an uptrend (bearish reversal) of the bottom of a downtrend (bullish reversal). Continuation patterns are used to indicate that the current direction of price movement will continue.

Both reversal and continuation patterns should be confirmed by a second pattern forecasting the same price behavior to follow.

Beyond price-specific indicators, technical analysis involves the study of volume, moving averages and momentum.

When volume is unusual or exceptional, it may forecast reversal. There are several volume indicators, but the strongest and most visible is the volume spike. This is a single or double session of unusually high volume, and an immediate return to more typical volume levels. Volume spikes are seen when strong reversal is indicated by a price pattern.

Moving averages are lagging indicators. When used to anticipate likely price movement, the application of two moving averages is useful. Typical in this form of analysis is a 50-session moving average and a 200-session moving average. Another form of moving average is the Bollinger Bands indicator. It consists of three bands. The middle band is a simple moving average of 20 periods. The upper and lower bands each are two standard deviations away from the middle band. The range created by the upper and lower bands define the likely trading breadth, and when price moves above the upper band or below the lower band, it invariably turns and moves back into range within a very short time period.

Momentum oscillators measure the speed and strength of a trend, regardless of direction. As momentum increases, the current movement is expected to accelerate as well. When momentum reaches a plateau and weakens, it anticipates reversal in the near future.

Indicators appearing close to resistance or support are the strongest, and if price violates these trading range borders, reversal is most likely. This is especially true if price moves through resistance or support with a strong gap. Gaps are likely to fill immediately after they appear.

Learn more about Technical Analysis:

1. Beginner’s Guide to Technical Analysis – Forbes.com

2. Technical Analysis of Stocks – Wikipedia.com

Video Education about Technical Analysis

Books about Technical Analysis

Value Investing

A value investment is defined in several different ways. For most people, it means a stock at a bargain price, available below the intrinsic value of the company. For other investors, a value investment is one managed exceptionally well, competitively strong, and paying a higher than average dividend.

Value investors tend to be conservative and to seek consistency and quality. In comparison, a growth investor is one seeking rapid appreciation in stock. Although this occurs in some cases, growth stocks tend to be higher-risk, so a growth investor is more likely to be a speculator.

These terms are not absolute. Both value and growth investors may find a mix of stocks for their portfolio. A balance between value and growth is one form of diversification. For many investors, this is a wise combination of attributes for a stock portfolio.

Learn more about Value Investing

1. Beginners Guide to Value Investing – Motley Fool

2. Strategies of Legendary Value Investors – Investopedia.com

Michael, thank you for posting this extensive article. I hope it benefits many people interested in starting an investment program. It was intended to expose the spectrum of possibilities, and also to provide links to other resources. Nice work!